Relinquishing goods

What does relinquishing mean?

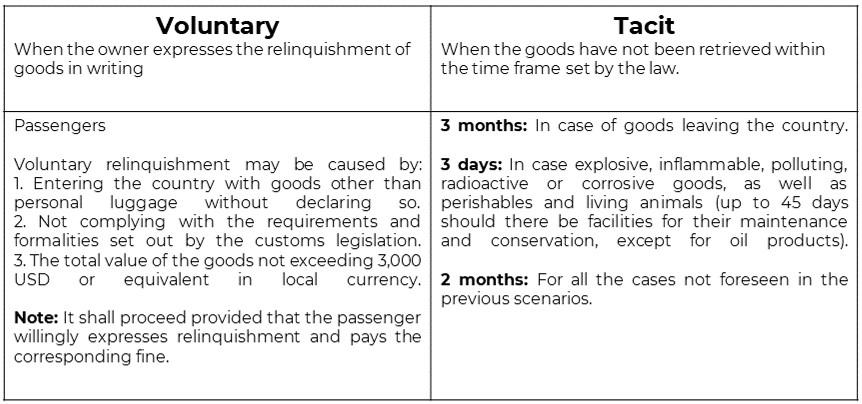

It is a taxpayer´s right which consists in transferring the ownership of property of the retained goods in favor of the federal tax authorities, if expressed in writing by the taxpayer or when the time frame set to retrieve the goods from customs or the fiscal area has expired.

Types of relinquishment

Notification

Once the time frame to retrieve the goods has expired, the customs authorities will personally notify the owners, at the address shown in the transport documentation, indicating that they have 15 days to retrieve the goods, provided that they have the corresponding permits and have paid the fines incurred.

If the 15-day time frame to retrieve the goods expires, it will be understood that they are now property of the federal tax authority.

In case it is not possible to notify in person because there was no address given or it does not correspond with the person, the notification will be made in stands at the customs entry point.

Other causes of relinquishment

It will also be cause of relinquishment in favor of the federal tax authority:

- The goods seized by the customs authorities resulting from inspection of the goods and when they are not retrieved within the corresponding months after the decision was communicated to the taxpayer.

NOTE: The two-month time frame will start one day after communicating the corresponding decision to the interested party.